From Intake to Payment: Three Controls That Keep Accurate Claims Flowing

Health plan claims leaders consistently ask the same question: What is the biggest driver of overpaid claims—and how do we prevent it before it becomes systemic?

The answer is deceptively simple: data.

Claims data is the backbone of system configuration, and configuration is what determines how claims are adjudicated—often automatically and at massive scale. When a rule, field, or value is wrong, the system doesn’t make a single mistake. It repeats that mistake thousands of times a day. That’s how minor data issues turn into major financial exposure.

To understand how overpayments really happen, it helps to rewind to the beginning of the claims lifecycle. Long before adjudication rules fire or payments are issued, claims data is transferred, ingested, indexed, and queued. Every step from intake to payment either preserves data integrity—or quietly degrades it.

Why Intake Is Where Risk Begins

The first real opportunity for bad data to enter the system is during intake. Errors can originate with the provider or biller, who may submit incorrect information; but they can also be introduced after the fact. Even when a provider submits clean, accurate data, mistakes during paper-to-electronic conversion or indexing can fundamentally change how a claim is processed.

This is why the mailroom plays such a critical role in claims performance. High-quality intake operations ensure that data is converted exactly as received, without interpretation, correction, or assumption. A small deviation, such as a misplaced decimal, is not “just” a clerical error—in an auto-adjudication environment, it becomes a multiplier.

Dates received are another high-risk data element. They determine regulatory compliance, dictate prioritization, and directly affect turnaround time performance. In states like California, where prompt-pay timelines and interest penalties can create real financial exposure, inaccuracies at intake can quickly translate into missed deadlines and direct financial exposure. If intake dates are incorrect, claims can fall out of compliance or accrue interest penalties, both situations that increase the risk of overpayment.

Adjudication Depends on Discipline, Not Speed

Once a claim reaches adjudication, accuracy depends on discipline. Correct processing is not about moving faster; it’s about ensuring that every prerequisite condition is met before the system renders a decision.

This includes validating that all data matches the claim form and supporting documentation, confirming member eligibility for the dates of service, and ensuring that authorizations are applied when required. Procedure codes must be payable under the contract or established processing guidelines, and applying appropriate coding edits (e.g., NCCI edits where applicable).

One of the most overlooked risk factors in adjudication is change management. Edits and rules should never be altered mid-cycle without formal change control and approval. Even well-intentioned tweaks can create churn, rework, and inconsistent outcomes.

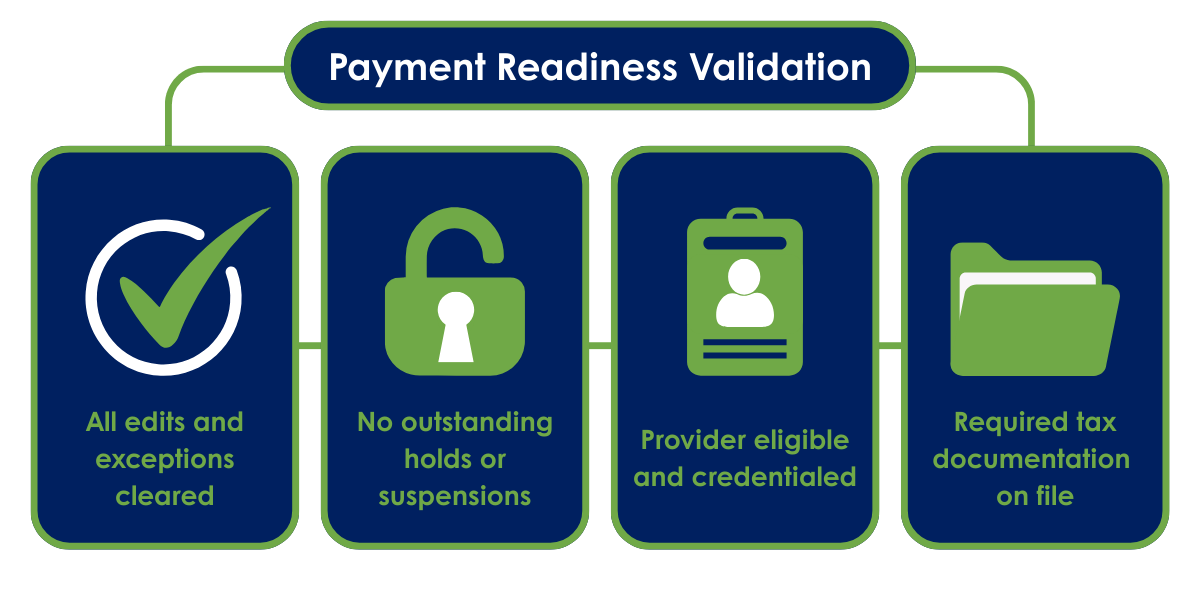

Payment Readiness Is More Than a Green Light

A claim that reaches the payment stage is often assumed to be “done,” but payment readiness requires its own set of confirmations. Adjudication alone is not enough.

Before funds are released, all exceptions and critical edits must be cleared, and there can be no outstanding holds or suspensions. The provider must be in good standing—properly credentialed and not listed on any preclusion or exclusion lists. A valid W-9 form must also be on file to ensure tax compliance. Skipping or rushing these checks doesn’t just create compliance risk; it creates payment leakage that is difficult to recover after the fact.

The Three Controls That Keep Claims Flowing

When claims operations struggle with backlogs, quality issues, or overpayments, the root cause is usually a breakdown in one of three core controls:

Intake integrity, which ensures that claims data is captured and indexed exactly as submitted, with accurate receipt dates and no interpretation or modification during paper-to-electronic conversion.

Adjudication governance, which requires that eligibility, authorization, coding, and contract rules are consistently applied, and that any changes to edits or logic follow a formal, approved change-control process.

Payment readiness validation, which confirms that all adjudication requirements are met, all exceptions are resolved, the provider is eligible and credentialed, and all regulatory and tax documentation is in place before payment is issued.

What happens when key adjudication performance factors slip under pressure?

This infographic breaks down five essential areas of claims adjudication performance so health plans can see where their weak links may be and where operational improvements are most needed. View the Infographic

Data Integrity Is Not Optional

The common thread across intake, adjudication, and payment is data integrity. One incorrect data point doesn’t stay isolated. In an automated claims environment, it can propagate across hundreds or thousands of claims. This creates outsized financial and operational risk.

The takeaway is clear: From the moment a claim enters the system to the moment payment is released, every handoff matters. Small errors become big problems when systems scale them. Claims leaders who invest in intake quality, adjudication discipline, and payment readiness controls don’t just prevent overpayments—they keep claims flowing.

Ready to Transform Your Claims Operations?

Modernize your health plan’s claims management with Imagenet. Learn how our claims adjudication solutions help health plans streamline processes, improve accuracy, and support intelligent claims processing at scale.