The Three Pillars of Intelligent Claims Operations: Training, Productivity & Quality for Future-Ready Healthcare Payers

By Malcolm Smith, Vice President, Claims

As healthcare payers face growing claim volumes, rising member expectations, and increasingly complex regulatory demands, the pressure to modernize payer claims operations has never been greater. Intelligent claims processing, powered by automation and unstructured data capture, is transforming the industry. But one truth remains: technology only works when built on a foundation of operational excellence.

At the heart of every high-performing payer claims operation are three core pillars:

Robust training

Intelligent productivity systems

Proactive quality controls

These pillars aren’t standalone. Strong training enables more efficient production. Higher productivity yields the volume needed for meaningful quality monitoring. And quality data, in turn, guides future training and system refinement.

Here’s a closer look at how each piece fits—and why they’re so critical in today’s healthcare environment.

Pillar One: Training for Scalable Claims Processing

“Training isn’t just about onboarding. It’s one of the most important tools we have for managing quality and compliance.”

Build the baseline. Then sharpen continuously.

In claims adjudication, examiners start with fundamentals like system navigation, benefit interpretation, and policy guidelines. But advanced training goes deeper—covering complex claim types, multi-day hospital stays, transplant episodes, and overlapping codes.

The best payer claims operations move beyond one-and-done onboarding. Instead, they:

Provide lecture-based learning for foundational knowledge.

Use job aids and desktop procedures for real-time guidance.

Require hands-on training with 100% auditing until accuracy is proven.

Leverage peer shadowing feedback to promote practical, system-specific best practices.

What differentiates high-performing claims operations isn’t that they use these tools; it’s that they adjust them in real time. When quality scores start to slip or new claim types are introduced, the best claims shops don't throw out blanket refresher courses. They direct targeted retraining to the teams and workflows that need it most.

As health plans adopt more intelligent automation tools, the role of human oversight shifts from execution to exception handling—making advanced, continuous training even more essential.

Pillar Two: Claims Productivity for Health Plans

“We don’t just manage claims; we engineer queues and continuously optimize the systems behind them.”

The demands on claims teams are only growing: higher volumes, tighter turnaround expectations, and mounting regulatory scrutiny. In that context, productivity can’t be left to chance. It has to be engineered.

That engineering goes beyond staffing models. High-performing claims operations are increasingly architected around orchestrated workflows: data-first queue logic, intelligent workload routing, and automation-assisted adjudication. This ensures the right resources—human or digital—are applied at the right moment for optimal speed and accuracy.

Key levers of engineered productivity include:

Data-first queue logic for intelligent workload routing, which balances demand and avoids backlogs.

Pods of examiners specializing in claim types, which accelerates decision-making and consistency.

Cross-training across claim types, which enables rapid pivots when client needs shift.

Automation-assisted adjudication embedded in workflows, which speeds throughput without sacrificing accuracy.

Moving away from the “catch-all queue” model is especially impactful. By replacing reactive processing with intelligent queue management, health plans improve throughput, safeguard compliance, and reduce audit exposure.

The lesson is simple: productivity is powered by design, not effort alone. Whether through queue architecture, examiner specialization, or intelligent automation, productivity must be built—not hoped for.

Pillar Three: Quality & Compliance in Claims Management

“A poor quality score isn’t just a number—it’s a compliance risk, a reputational issue, and a provider abrasion problem.”

Catch errors before they cause damage.

Denial rates across payers jumped 51% between 2021 and 2023 (AIHC, 2024). This increase came despite heavy investments in automation—proof that tools alone don’t ensure quality. Intelligent systems still require intelligent oversight. Human judgment, internal controls, and structured quality assurance remain essential for accurate, compliant claims management.

High-performing claims organizations embed quality review into the lifecycle of every claim, not just after the fact. For new or complex claim types, teams often route 100% of claims through QA until patterns are established. That safeguard helps prevent:

Costly rework and reprocessing

Provider abrasion from incorrect denials or delayed payments

Compliance risk from systemic non-conformance

The stakes are high: administrative complexity drives an estimated $265.6 billion in waste annually across U.S. healthcare (2022 estimate). A robust QA process helps payers avoid these costs, including reducing claim denials, while protecting provider relationships and member trust.

Just as important, QA programs provide actionable intelligence. Well-structured data doesn’t just assess examiner performance—it informs retraining, strengthens automation logic, and continuously improves claims accuracy. When quality monitoring is data-driven, trends by examiner, claim type, or system can trigger proactive interventions instead of reactive clean-up.

The lesson is clear: quality assurance is more than a safeguard—it’s a strategic asset. By embedding QA into orchestrated workflows, health plans can mitigate compliance risk, reduce waste, and strengthen the very automation tools they’ve invested in.

Closing the Loop: The Continuous Cycle of Claims Performance

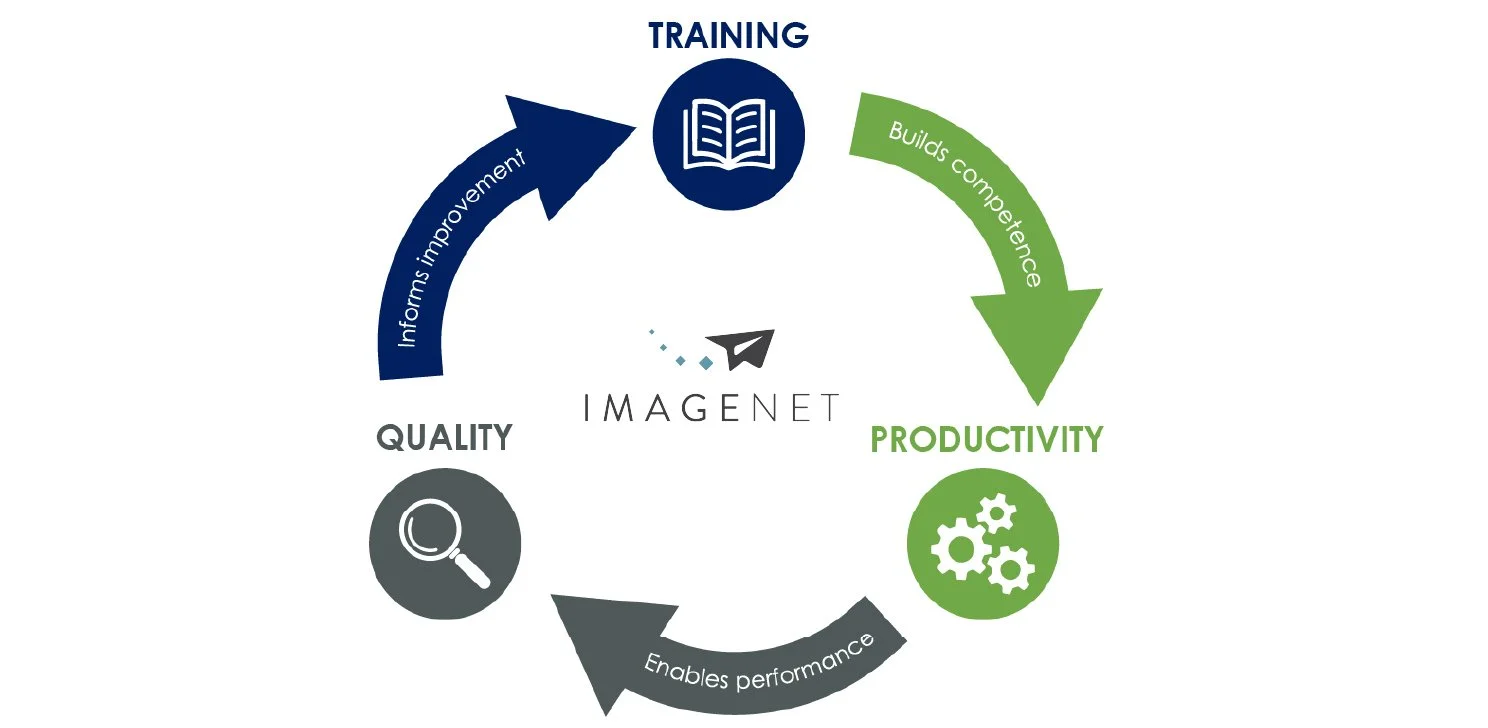

These three pillars form a feedback loop that enables intelligent claims operations:

Training builds foundational competence.

Productivity enables consistent performance at scale.

Quality monitors that performance—and feeds back into training when needed.

This operational framework becomes the foundation for intelligent claims transformation. By embedding training, orchestrated productivity, and continuous quality feedback into your operations, health plans are not just ready for automation— they’re able to reduce claim denials, improve claims accuracy, and scale with confidence.

Ready to Transform Your Claims Operations?

Modernize your health plan’s claims management with Imagenet. Learn how our claims adjudication solutions help 150+ health plans streamline processes, improve accuracy, and achieve intelligent claims processing at scale.

Malcolm Smith serves as Vice President of Claims for Imagenet, overseeing claims delivery teams across U.S. and global hubs. He brings more than 20 years of expertise in claims operations, payment integrity, and compliance. His background includes leading cross-functional teams focused on audit readiness, overpayment recovery, and post-payment compliance for national health plans. At Imagenet, Malcolm directs strategies to enhance throughput, sustain compliance, and help health plans meet rising demand with precision and confidence.